An Interview with David Esrati

Disclosure: David Esrati is a founding member of Reconstructing Dayton On Friday we sat down and talked with David Esrati, candidate for Ohio's 10th Congressional District. Esrati has been a fixture in Dayton politics for years due to his perpetual appearance on local ballots despite the fact that he has yet to win. He argues that this experience makes him best equipped to face Mike Turner in the general election, while also touting his business experience and work as a "citizen journalist."...

An Interview with Baxter Stapleton

Baxter Stapleton is running as a Democrat for Ohio's 10th Congressional District. In the primary he will oppose Kirk Benjamin, David Esrati, and Jeff Hardenbrook. Baxter is decades younger than his three opponents and he believes that his youth will be an asset to an aging Congress. His campaign slogan, "Multiple Not Divide," embodies a hopeful message that is reflective in much of his rhetoric. As the child of two NCR employees, he has a quintessentially Dayton origin story, but Baxter also...

An Interview with Kirk Benjamin

Kirk Benjamin is currently running as a Democrat for Ohio's 10th Congressional District. He was kind enough to sit down with Reconstructing Dayton to tell us about himself and his platform. Benjamin originally hails from Dayton and spent much of his life working on computers in Silicon Valley. He has a very unconventional platform and is running a very unconventional campaign. Originally, he had hoped that the media attention from running for Congress would help him publicly advocate for his...

Mysterious Meetings for Mysterious Contracts

Note: We apologize for the lack of content recently. We have been quite busy behind the scenes doing research and advocating for public policy. If you would like to receive updates when we publish new content please subscribe at the bottom of the page. The Meeting Shared Resource Center (SRC), a government organization that functions to outsource basic school administrative functions, has landed a contract with Dayton Public Schools. On its face, that news is pretty unspectacular. Certainly...

Ohio Elections Subvert the Will of the People

On Tuesday, Ohio held a couple of special elections that have attracted quite a bit of national interest. Progressive heartthrob Nina Turner lost to Shontel Brown in a primary for the 11th Congressional District and Trump-backed conservative Mike Carey emerged victorious from a crowded field in the 15th Congressional District. The national narrative regarding these races revolves around the establishment v. outsider dynamic present in both contests. Others look at Donald Trump and Jim Clyburn...

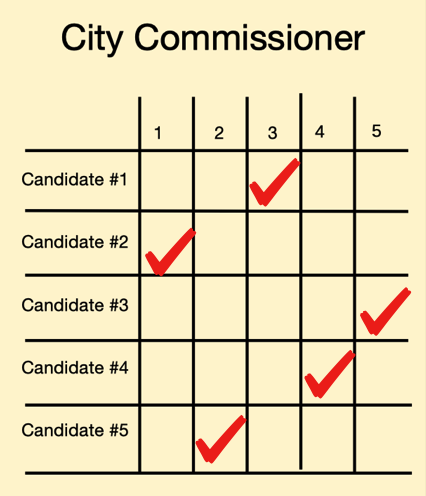

Ranked-Choice Voting is on the Way!

We provide some updates on the status of our ranked-choice voting ballot initiative. If you live in the Dayton area, please consider volunteering so that we can collect the requisite signatures in time for our initiative to appear on the ballot.