But, we’ve always done things this way…

Don’t let the pretty dog fool you into liking County Auditor Karl Keith, he’ll raise your taxes and take your home in a heartbeat.

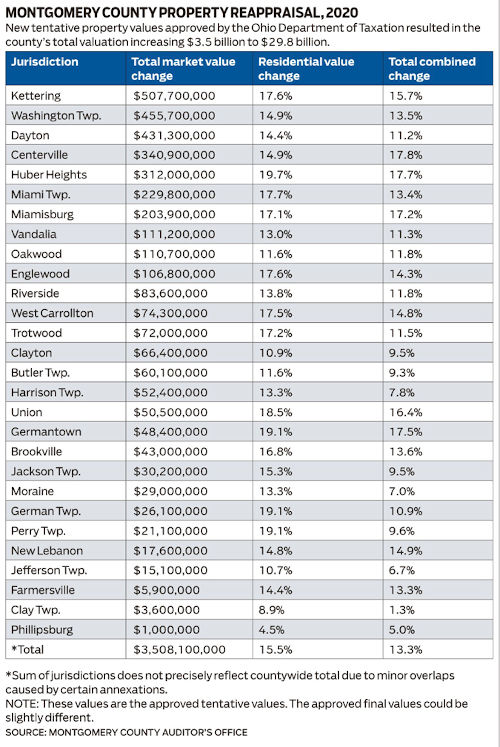

Why do we make things so complicated? That question drives much of the work at Reconstructing Dayton. Properties values in Montgomery County will increase 15% after the most recent round of revaluation by Auditor Karl Keith, twice what he actually pegged the increase at, because the state Department of Taxation didn’t like his figure. They wanted an 18% increase and the two parties disputed for months before agreeing on 15%, which works out to, well, $3.5B. What are we getting for that money? 30 jurisdictions, umpteen school districts with overpaid superintendents, etc. See our intro page video. We believe there is way to cut at least 20% of our government overhead by consolidation, but no one is talking about that right now.

The whole property tax process is insane. Every six years the auditor has to officially revaluate property, an unreliable and arbitrary process. Usually they just look at your house from the outside, but according to state law they have the right to enter and inspect the entire property. This revaluation process is costly and requires the auditor’s office to employ a robust staff. We literally pay out the wazoo to play guess the valuation. What’s worse is it contributes to gentrification, penalizes people for fixing up their single most valuable investment and causes blight when people abandon neighborhoods because people in poverty can’t afford a 15% hike.

In the past Reconstructing Dayton looked at how the revaluation process is susceptible to the whims of housing bubbles but not bursts. We also looked at some possible solutions to prevent rampant tax hikes. Today we want to consider why this convoluted system exists in the first place.

Property Values in Montgomery County increased by $3.5 billion. Hard to believe, right? Source: Dayton Daily News

According to the Ohio State Constitution, “The General Assembly shall provide by general law for the organization and government of counties, and may provide by general law alternative forms of county government.” Basically, there is an established structure for county governments and if a county forms a charter to deviate from that structure, they must still conform to certain provisions. Conventional counties have an auditor, a treasurer, and all the other characters we vote on every four years. In a charter government, such as Summit, the auditor and treasurer can be combined into a single position. Summit can do this, but they cannot eliminate the auditor altogether. State law prescribes certain responsibilities such as revaluating all property within a county and then having those revaluations approved by the State Department of Taxation.

The process is complicated. It’s messy. It creates legal disputes. It’s inefficient. Perhaps the only good thing one can say about it is that it provides jobs to thousands of number crunchers and lawyers. So why do we have this system? Because that’s the way we’ve always done things.

The primary impediment to improvement is an assumption that things must be the way they are. Let’s rethink property taxes.

Things Could be Better

Considering a home is the largest investment that most American’s will make, why should your personal home be treated different than a billionaire’s stock investment? For stocks, taxes are only calculated on the difference between the buying price and the selling price. You don’t pay taxes on holding the stock, nor does it matter what the value is, except when you sell. This is the most fair way to treat homes for most Americans, people who don’t invest in the risky and volatile stock market, but instead invest in their own home, neighborhood, and community. We believe that taxes should be calculated by fair market forces and you should be rewarded—not penalized—for improving your home and your neighborhood. If a city can’t protect home values and disinvestment does occur, those who take the most risks should be entitled to the greatest rewards. This means that homes ought to be taxed based on the purchase price.

Taxing homes based on the purchase price is simple and fair. When it comes to rentals, we could just impose a tax based on the rent. This would ensure that property revaluations won’t force landlords to raise rents. If such a system were implemented, we could gut the Ohio Revised Code of many provisions that require regular appraisals of all property because they would be unnecessary. The auditor’s office would not require nearly as many employees. Not only would tax payers receive lower property tax bills, but they also wouldn’t have to fork over a bunch of money to fund the perpetual revaluation process and all the legal baggage attached to it.

When it comes to commercial properties, we could also create a tax structure that incentivizes business while maximizing tax revenue. Companies frequently drag auditors through the courts and contest appraisals until they pay the minimum possible amount of taxes. The really big companies also use their clout to bully local governments into providing tax abatement. If we had a single formula to collect commercial property taxes—no exceptions allowed—then we could get rid of the litigation and unnecessary corporate handouts. For example, we could use square footage, purchase/lease price, and number of employees as our factors. Higher square footage and higher purchase/lease price results in a higher valuation. The more employees that earn above a poverty-wage salary, the greater a deduction the business receives. A formula like this would guarantee that businesses pay their fair share while also rewarding them for providing good jobs. No tax abatement necessary.

Artistic rendition of an audit.

The auditor will still have a role, albeit a greatly reduced one. New buildings will have to be audited if not sold by the property owner. While we do not think that residential homeowners should be penalized for making improvements to their property, we do think it makes sense to revaluate commercial properties when large-scale improvements are made. If we didn’t, companies would find ways to skirt around the rules. And, as always, the auditor will be responsible for making sure gas pumps aren’t ripping people off and other measurement-related work.

Things that Concern People

We floated this idea around to some local political figures, such as Zach Dickerson, Bob Matthews and John McManus. They each had some legitimate concerns that need to be addressed.

Unintended Consequences

Zach Dickerson thought our property tax idea was a pretty good one, but he was reticent to endorse it because he was worried about unintended consequences. He wanted to know that it could work before making any commitments. Fortunately, since 1978 California has had a similar system. In California, property is assessed at the purchase price and then increases annually either at the rate of inflation or 2%—whichever is lower.

After forty-two years of use in California, the system is undeniably workable. California has the largest economy of any state and, if it were a sovereign country, it would be the fifth largest economy in the world. Despite an exorbitant cost of living, limiting housing options, and persistent natural disasters, people still continue to move away from Ohio to live in California. The success of California has absolutely nothing to do with the way they assess property, but it sure hasn’t hurt them. California has faced challenges from corporations using this system to avoid paying their fair share. Corporations tend to stay put longer than individuals and they live longer, too. Our plan would not have this weakness.

Tax revenue will not keep up with inflation

Bob Matthews expressed concern that tax revenue would not keep up with inflation, meaning that the county will become starved of funds if revaluations don’t take place. Basically, if someone buys a house for $20,000 in Dayton (which can be done!), fixes it up, and owns it for decades, they will continue to be taxed as if their house is only worth $20,000. We could implement a system like California’s that adjusts prices for inflation, but it isn’t optimal because it doesn’t provide the extra incentive to invest in one’s home and community.

The reality is that it’s extremely rare for people to remain in the same home for decades. In Columbus, the median length of residence is 11.9 years. If drastic inflation occurs over that time period, we have bigger problems. For people who do stick it out, it seems fitting to reward them with lower taxes. This will enable them to improve their property without the fear that it will increase the amount of taxes they owe. Rewarding homeowners is a good way to develop neighborhoods. Here in Dayton, where you can’t drive down any street without seeing a derelict house, we need incentives to buy and fix up houses. The best way to increase property tax revenue is to turn vacant homes into occupied homes. Dayton has a huge backlog of homes to demolish thanks to failed policy- causing every homeowner to share the burden in fixing someone else’s mistake.

Fraud will become commonplace

John McManus thought our ideas for property tax reform sounded pretty good, but he was afraid to endorse the idea because of the potential for fraud. Basically, by shuffling money around someone could sell a house to an intermediary who then sells the house at a greatly undervalued price. If I want to buy a house from Steve, I could give Jane $150,000 to buy the house, and then buy the house from Jane for $5,000. Commercial entities could do this using shell companies and control the entire process.

If you have ever been to a title office, you may have noticed signs declaring it’s a crime to report your car as purchased for less than the actual price. When cars are sold for cash, people often report a lower purchase price to minimize the sales tax. The difference with real estate is that it is extremely rare to buy a piece of property with cash. By implementing appropriate penalties—including a loss of license for real estate agents—it seems unlikely that fraud would be common. The auditor’s office, in conjunction with the recorder’s office, could investigate fraud. And since the auditor would continue to reassess commercial properties, it would make no sense for a business to attempt this kind of fraud.

Things that Need to Happen

Problems such as a convoluted audit system are particularly difficult to change because they are baked into state law. State legislators see no reason to change things—they’re too busy fighting the culture wars—and local officials see themselves as hamstrung by state law. Because of state law, even if we were to change how we collect property taxes, the auditor would still be forced to audit all property in the county every six years to comply with state law. It wouldn’t matter that we don’t use those figures, he’s still legally bound to tabulate them. However, the state legislature won’t see the pointlessness of this requirement until some county demonstrates that there’s a better way.

The state legislature is controlled by Republicans and it looks like it will remain in Republican hands for years to come. The Republican base loves lower taxes and small government, so if we are able to demonstrate a system that lowers taxes and shrinks a bloated government bureaucracy, it shouldn’t be too difficult to get them to change the Ohio Revised Code to get rid of all this auditing. That’s why we need to start local. Make changes here in Montgomery County and lead by example.

How to make it happen

Reconstructing Dayton is a non-profit that works to bring sensible change to our local government, from ranked choice voting, to changing the way we value properties. To continue to do the research, and force the issues to the forefront, we need to solicit donations. If you want to support these efforts, please subscribe, donate, and spread the word.

0 Comments

Trackbacks/Pingbacks